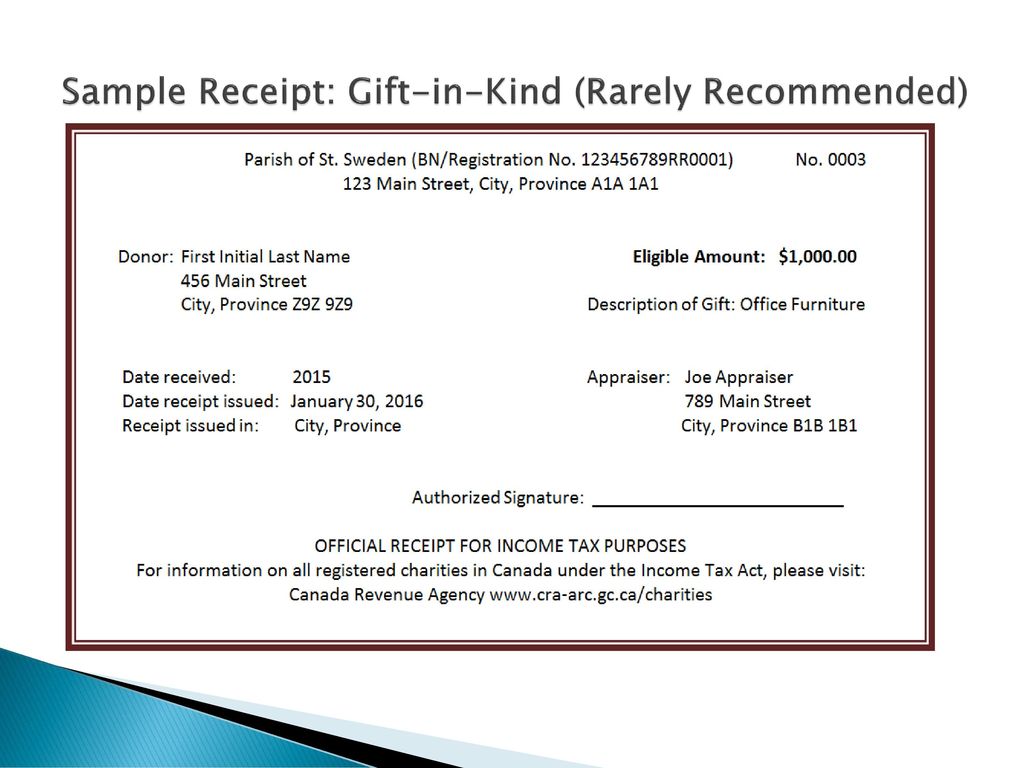

gift in kind tax receipt

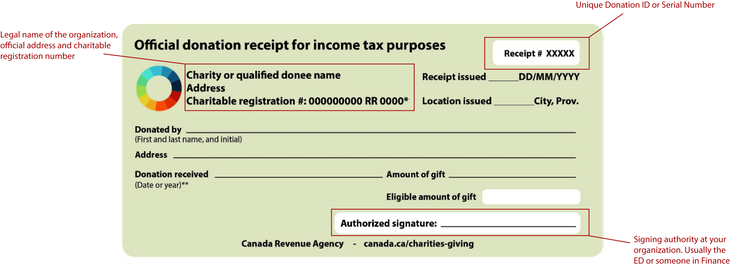

The Canadian Income Tax Act permits non-profit organizations with charitable status to issue receipts for income tax purposes for donations that qualify as gifts. The value of the in-kind donation in question.

A Complete Guide To Donation Receipts For Nonprofit Organizations

Before you issue a tax receipt you must determine if you have truly received a gift according to the Canada Revenue Agencys CRAs definition.

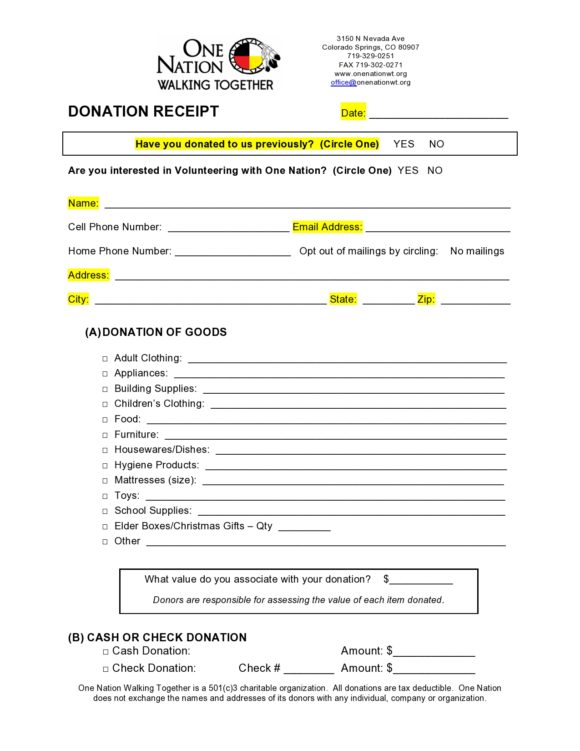

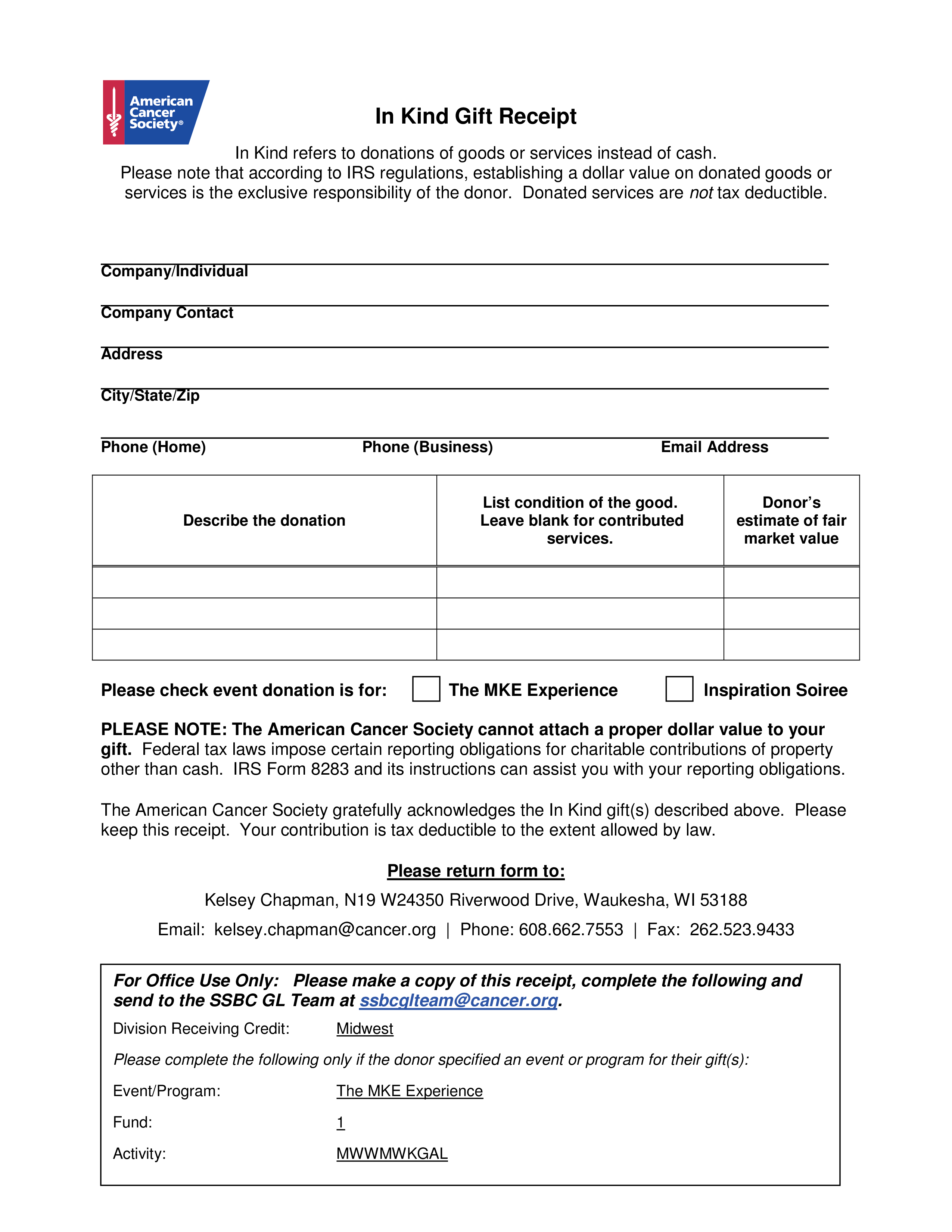

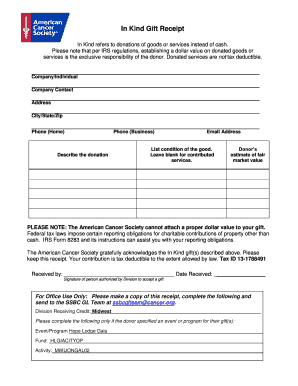

. The American Cancer Society gratefully acknowledges the In-Kind gifts described below. Please keep this receipt. Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits.

Fashion 900 600 Adult Boots. In kind donors do not receive any goods or services for their. Jersey Inheritance Tax Receipts Up.

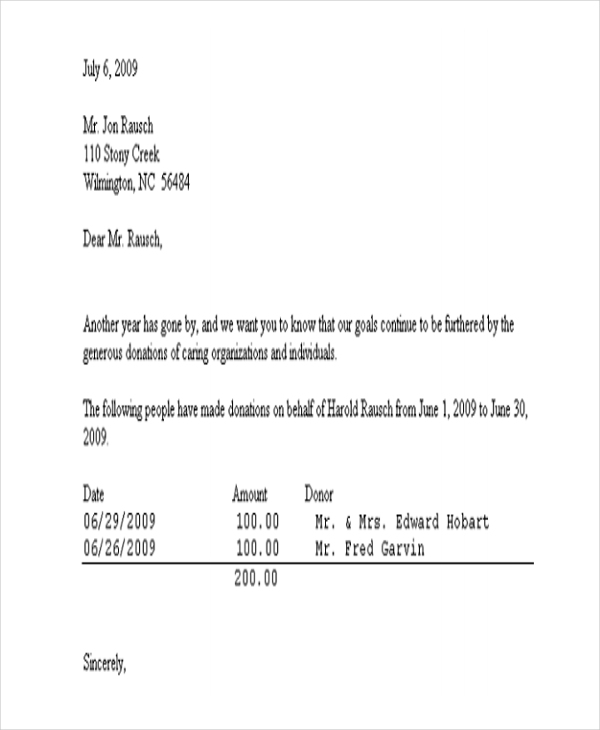

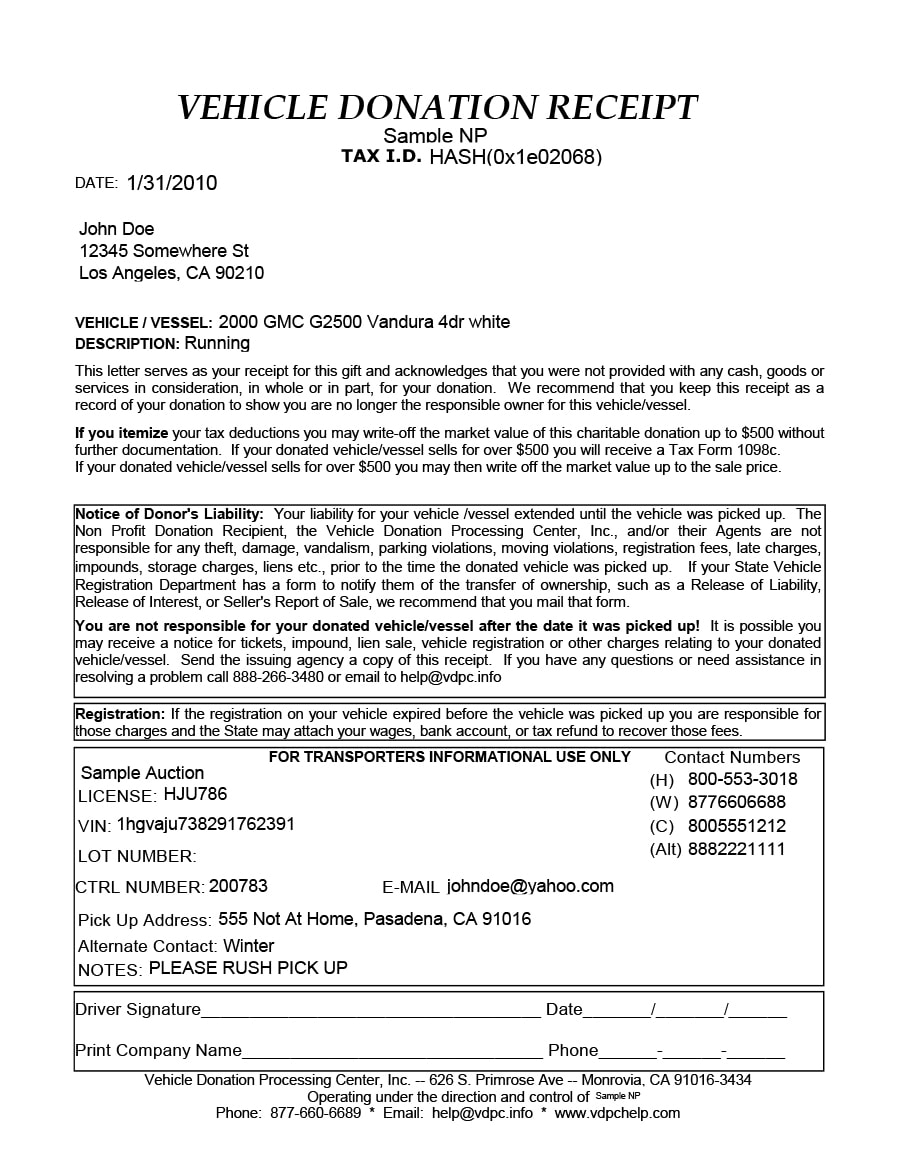

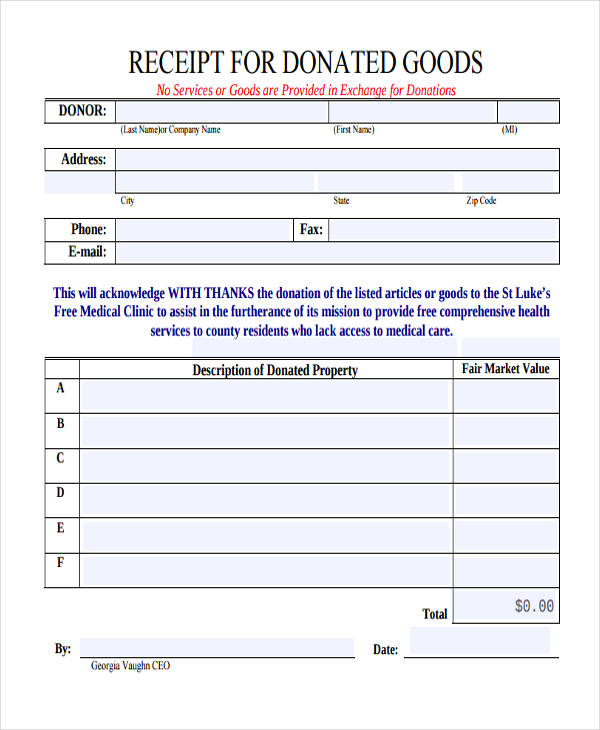

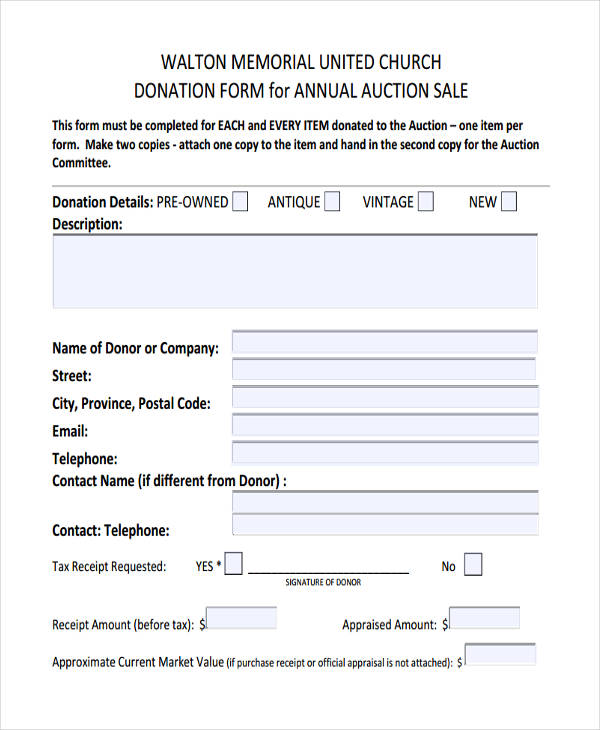

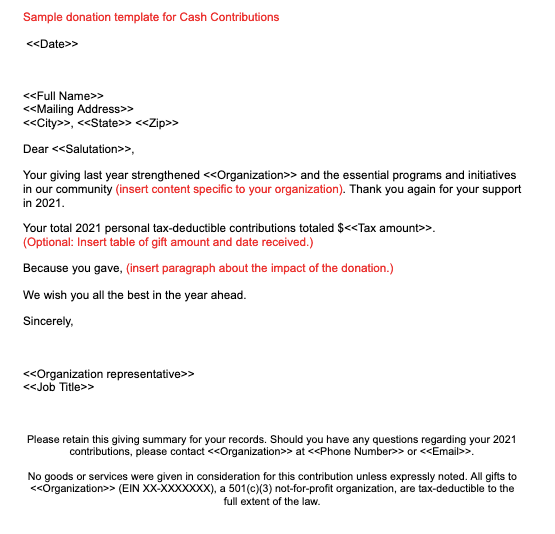

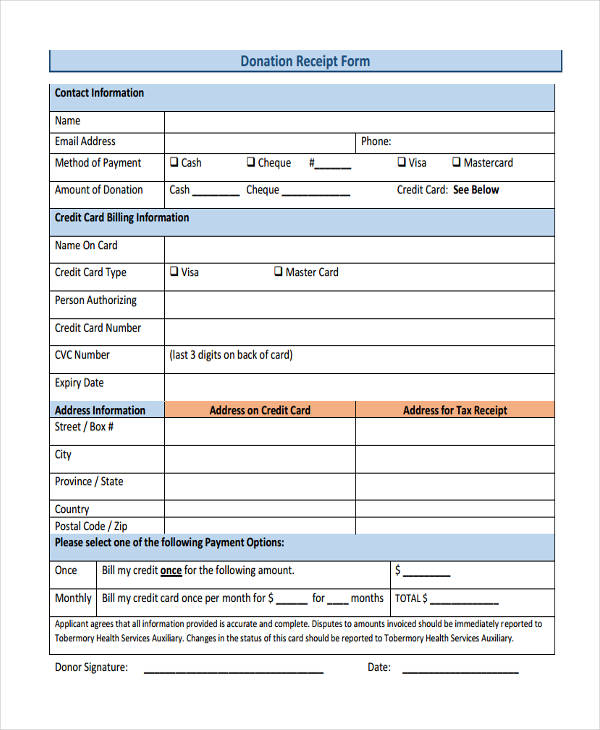

The giver does not have to file a gift tax for money or property given worth less than this amount and the recipient does not have to report this gift as long as the total tax year gift amount from. Who can write an official receipt for income tax purposes on behalf of the charity. A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received.

A gift must be given. High value medium value Adult Boots. Your donation helps to make an immediate difference in the lives of the homeless men women and children we meet every week in New York City Newark Irvington and Summit NJ.

Trinity School of Durham and Chapel Hill gratefully acknowledges the In-Kind gifts described below. When it comes to in-kind. Therefore the advantage must be 50 or.

Charitable donation receipts contain any and all information. Anyone can read what you share. Give this article Give this article Give this article.

Is a gift eligible for a receipt. According to GAAP guidelines the IRS requires tax receipts be provided for gifts of 250 or more. My tax software gave values for the items.

Fashion 1700 1100 Youth Boots. Once youve determined the value of your in-kind donations and collected the proper donation receipts you will complete the appropriate form s to report it. 10 of 500 is 50.

As a subscriber you have 10 gift articles to give each month. In-kind donors do not receive any goods or services for their. Please keep this receipt.

The following calculations are used to determine the eligible amount of the gift for receipting purposes. For non-cash donations gifts-in-kind a charity must issue a separate receipt for each gift.

5 Donation Acknowledgement Letter Templates Free Word Pdf Format Download Free Premium Templates

Gifts That Give Back Ebay For Charity

40 Donation Receipt Templates Letters Goodwill Non Profit

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Donation Gift Receipt Quid Pro Quo Small Business Free Forms

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Templates Silent Partner Software

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Templates Silent Partner Software

In Kind Gift Receipt Templates At Allbusinesstemplates Com

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Fillable Online Acsmwdcr Ejoinme In Kind Gift Receipt Acsmwdcr Ejoinme Org Fax Email Print Pdffiller

Touchpoint Software Documentation Non Tax Deductible Gifts And Pledges

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

24 Printable Church Donation Receipt Template Forms Fillable Samples In Pdf Word To Download Pdffiller